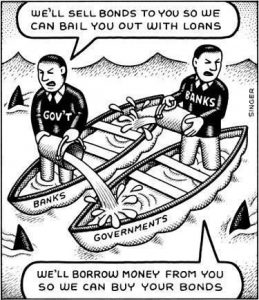

In the aftermath of a negative public reaction to the bailing out of banks with taxpayer money following the 2008 Credit Crisis, Congress passed a law in which future crises in the financial system would be settled using the bank’s own customer accounts in what would become known as a bail-in procedure.

Yet on June 13, the possibility of a taxpayer bailout of a financial institution or sovereign government came back to the forefront as the Supreme Court ruled today that the territory of Puerto Rico does not have the authority to default on their debts, and only Congress has the power to legislate bailouts to aid or satisfy the obligations.

The U.S. Supreme Court rejected Puerto Rico’s bid to let its public utilities restructure bonds over the objection of creditors, leaving the island’s $70 billion debt crisis squarely in the hands of Congress.

Siding with investors, the court ruled 5-2 on Monday that Puerto Rico’s measure was barred under federal bankruptcy law. The island’s debt gained after the decision, with some utility bonds jumping more than 3 cents on the dollar. Still, most of Puerto Rico’s debt is still trading at levels that signal further defaults are expected.

A decade-long economic slump has driven Puerto Rico to the brink of bankruptcy. The island has missed several payments this year and faces its biggest hurdle yet on July 1 when $2 billion in debt comes due. U.S. lawmakers are preparing to place its finances under direct federal oversight, and the Supreme Court ruling confirms that all roads to a debt settlement now lead via Washington. - Bloomberg

Interestingly, since the one-time bailout by the Federal government took place, it has been central banks like the Federal Reserve, ECB, and the Bank of Japan which has participated in buying sovereign debts under their Quantitative Easing initiatives. And now one has to wonder if even the Fed will any longer have the authority to bailout sovereign entities through the purchasing of their state and municipal bonds due to this Supreme Court ruling.

Heading into the final months of the 2016 election cycle, the hot potato that has been Puerto Rico has now landed squarely back into the laps of a Congress who wants nothing to do with fixing the problem, and putting their names (votes) in the public sphere heading into November. And while the island territory will not be large enough to trigger a national or global financial crisis through their ongoing defaults, it does bring back to life the potential for the taxpayers to engage in another bailout which the government hoped they would never have to deal with again.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne

- Migliori Casino Online Non AAMS