Has anyone actually wondered why the stock markets worldwide shot back up to new all-time highs following the Brexit vote when they were in a slow decline prior to this historic event? The answer of course is an incredible amount of newly money printing by global central banks, which bought stocks and indices by the boatload during the summer’s low volume period.

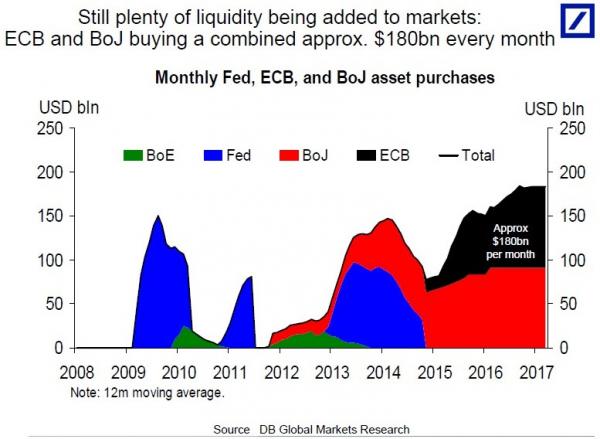

Quantitative Easing by the Fed was supposed to have ended a year and a half ago, but new data actually suggests that the four primary Western central banks are still printing over $1 trillion every six months to keep the markets and economy afloat just above flat-lining.

The monetary policy beatings will continue until morale improves. Eight long years after monetary policy experimentation went extreme, Reuters reports the amount of QE stimulus being pumped into the world financial system has never been higher… and it’s about to get bigger.

As Jamie McGeever reports, The European Central Bank and Bank of Japan are buying around $180 billion of assets a month, according to Deutsche Bank, a larger global total than at any point since 2009, even when the Federal Reserve’s QE programme was in full flow. - Zerohedge

More than a year ago, it took approximately $14 dollars in new money just to create $1 in GDP growth. And despite the fact that the Bank of Japan owns over half their their Nikkei stock markets, and the European Central Bank is now buying corporate bonds to prop up their low earning companies, global GDP is still below 3% while debt continues to rise at astronomical rates.

When the world went off the gold standard in 1971, the global economy no longer was a capitalist enterprise, and instead it morphed into a purely credit one. And this is why central banks have had to continuously create new money backed by nothing simply to be able to roll over outstanding debts, and formulate bubbles that make economies look like they are growing. But the sad fact is that the world is now on a collision course for debt implosion, because it would take nearly six years straight of using the total amount of the world’s gdp being dedicated towards paying off the $300 trillion in debt, to once again bring the gloabal economy back to equilibrium.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne