By now every real investor knows that stock markets are rigged not on fundamentals and technicals, but on Federal Reserve and ESF interventions. And no greater example of this can be evidenced when Goldman Sachs, who reported a decline of 55% in last quarter earnings, saw their stock go up during today’s trading.

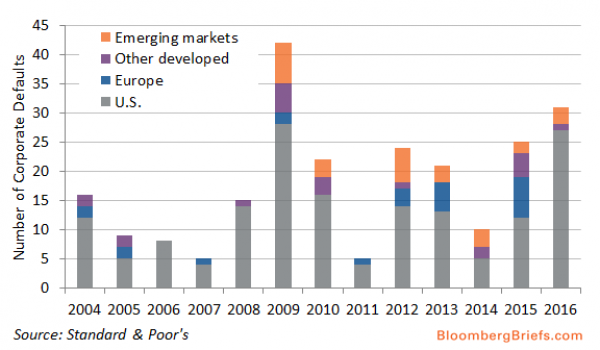

But underlying it all is a growing plague of debt and margin calls, and since the beginning of the year, 46 corporations have defaulted on their debt, which is the highest level seen since 2009, and the beginning of the Great Recession.

Get ready to step over some landmines, investors. The number of companies defaulting on their debt is hitting levels not seen since the financial crisis, and it’s not just a problem for bondholders.

So far this year, 46 companies have defaulted on their debt, the highest level since 2009, according to S&P Ratings Services. Five companies defaulted this week, based on the latest data available from S&P Ratings Services. That includes New Jersey-based specialty chemical company Vertellus Specialties and Ohio-based iron ore producer Cliffs Natural. Of the world’s defaults this year, 37 are of companies based in the U.S.

Meanwhile, coal producer Peabody Energy (BTU) and surfwear seller Pacific Sunwear (PSUN) this week filed plans for bankruptcy protection. - USA Today

Energy companies sit atop the list of insolvent corporations, but not far behind are risky banks which hold trillions of dollars in debt for both the oil industry, and emerging markets. And should lower oil prices continue to pervade the market as we head into summer, this number will greatly increase, and force layoffs in the hundreds of thousands.

Wall Street and Washington refuse to admit the world is right now in a global recession, and as such they continue to mask dozens of problems that are unfixable without new and costly interventions. And perhaps this is why analysts are moving away from interest rate hikes from the Fed for the rest of the year, and bringing up the possibility of new rounds of quantitative easing at a time when growth for the second quarter is about to fall below zero.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne