At the core of the nation’s colossal debt bubble is of course the Federal Reserve, and their zero/negative interest rate and money printing policies that have destroyed many sectors in the overall economy.

And one of the biggest victims of the Fed’s capital destruction is without a doubt the multitude of local, state, federal, and private pension funds that require high returns on their investments, and which need to refrain from buying and holding risky assets like equities as much as possible.

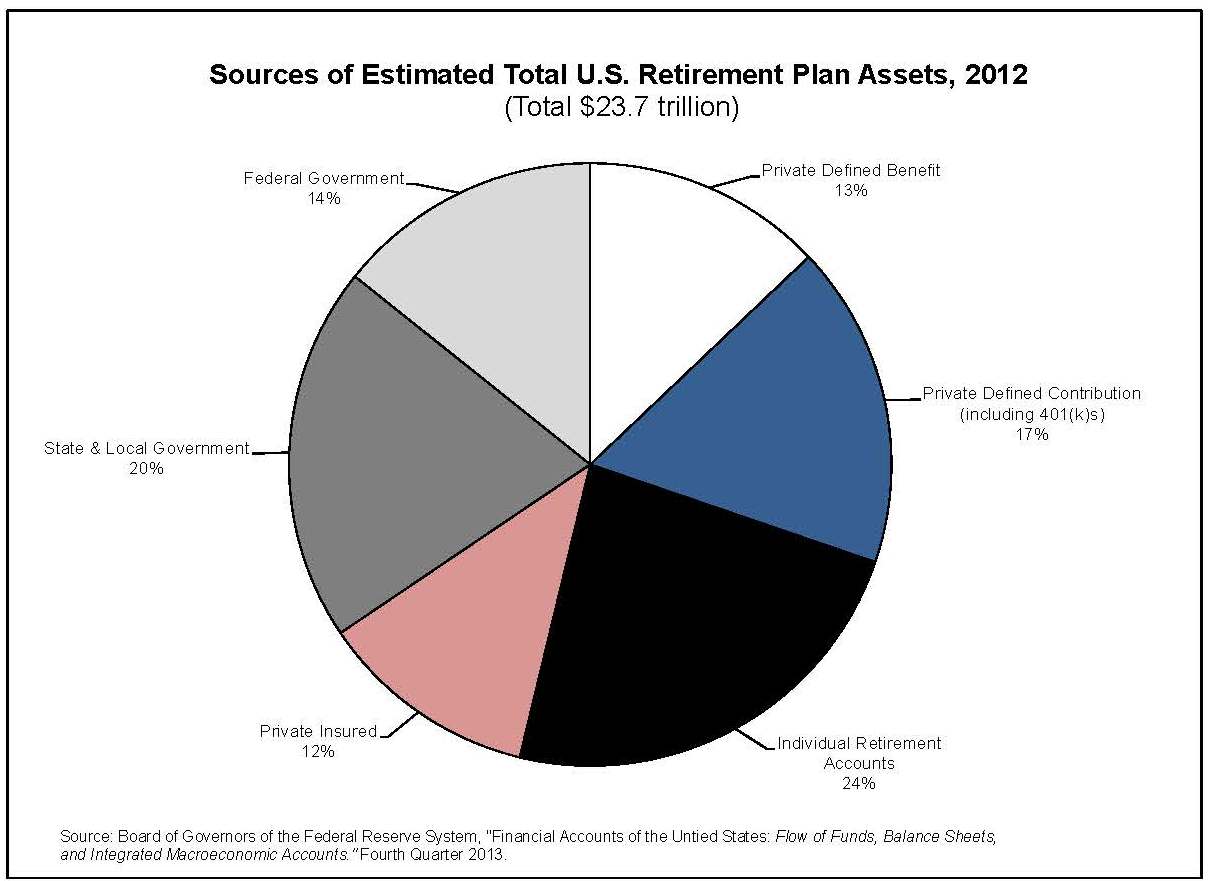

However with bond yields at virtually nothing, and in some cases even below zero, managers of the country’s 24 trillion (in 2012 numbers) in pension and retirement accounts are being forced to go outside the box as underfunded accounts now total more than $2 trillion, and are causing some entities like Calpers and Central States to limit benefit payouts, or even cut out benefits altogether.

And the newest scheme that is taking place from two public retirement funds is the selling of options on their equity holdings.

Back in the early-to-mid 2000’s large pensions and insurance companies made a very large bet on a “sure thing”. They sold trillions in notional value of credit default swaps (CDS) on mortgage backed securities. The bet was a “no brainer” as the insurance companies could collect a solid coupon payment for insuring risk on “investment grade” credits backed by U.S. housing, an asset class that had basically never declined in value. Well, as we all know, in the end, that bet didn’t work out that well resulting in a government bailout of many financials, including AIG, which received over $180BN.

Well, turns out, some of the “smart money” in this country either didn’t learn much from that event or doesn’t remember it. As theWall Street Journal pointed out over the weekend, pension funds in Hawaii and South Carolina have adopted a new strategy, in their thirst for yield, that involves selling puts. While the insanity of the domestic equity markets, which seem to indiscriminately soar to new highs every day, might convince some that, like housing circa 2006, equity values never actually decline, Nathan Faber of Newfound Research says:

“There comes a point where you might be picking up pennies in front of a steamroller.” - Zerohedge

In the game of options, one sells calls on equities they own to collect a premium as a hedge in case the value of their stocks go down in price. Similarly, one sells puts if they hope to buy a stock they do not own at a lower price, or to buy more of what they own should the price go down.

Call Options Vs. Put Options

Very simply, an equity option is a derivative security that acquires its value from the underlying stock it covers. Owning a call option gives you the right to buy a stock at a predetermined price, known as the option exercise price. A put option gives the owner the right to sell the underlying stock at the option exercise price. Thus, buying a call option is a bullish bet - you make money when the stock goes up, while a put option is a bearish bet because if the stock price declines below the put’s exercise price, you can still sell the stock at the higher exercise price.

The exact opposite view is taken when you sell a call or put option. Most important, when you sell an option you are taking on an obligation not a right. Once you sell an option, you are committing to honoring your position if indeed the buyer of the option you sold to decides to exercise. Here’s a summary breakdown of buying versus selling options.

Buying a Call - You have the right to buy a stock at a predetermined price.

Selling a Call - You have an obligation to deliver the stock at a predetermined price to the option buyer.

Buying a Put - You have the right to sell a stock at a predetermined price.

Selling a Put - You have an obligation to buy the stock at a predetermined price if the buyer of the put option wants to sell it to you. - Investopedia

Thus the point of these pension funds going full retard is that what they might gain by selling put options would be completely wiped out should they have to then buy the stock at the price and amount their put contracts designated. Thus the potential risk that comes with selling puts virtually negates any real ‘yield’ gain if the markets become volatile, or decide to crash.

Perhaps the only real reason the financial industry has not taken the Federal Reserve to task is that all the cheap money they have been able to borrow has been greater than the loss in true yield they used to gain when interest rates were at normal levels. But as many of the major hedge funds are now dumping their stocks, and in some cases even shorting the market to the tune of billions of dollars, to use people’s retirement funds to try to sell puts for yield when the market is sitting at the end of a QE induced bull market is one of the most idiotic schemes any money manager could ever imagine.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne