On March 29, Fed Chairman Janet Yellen spoke at the Economic Club of New York to give a little more insight to the central bank’s future plans for monetary policy. And in what was a mish-mash of contradictory points provided by the Fed Chair, where in one instance she praised the economy as being good while shortly after called for caution due to uncertainty in that same economy, it appears that data announced from the Atlanta Fed on Monday has invariably thrown all future rate hike possibilities in the crapper.

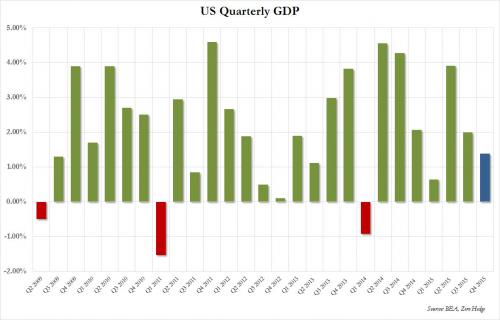

“the Atlanta Fed will have no choice but to revise its Q1 “nowcast” to 1.0% or even lower, which would make the first quarter the lowest quarter since the “polar vortex” impacted Q1 of 2015, and the third worst GDP quarter since Q4 2012. It means one-third of already low Q1 GDP growth has just been wiped away.”

It was “even lower.”

Moments ago the Atlanta Fed which models concurrent GDP, slashed its Q1 GDP from 1.4% (and 1.9% last week) to a number not even we expected: a paltry 0.6%, which would match the “polar vortexed” GDP print from Q1 2015.

Should the number drop even more, will be the lowest since Q1 of 2014 when the US economy suffered its most recent contraction of nearly -1%. - Zerohedge

For the past two years, government reported unemployment rates have been the primary data point used by the Federal Reserve to construct monetary policy, despite the fact that everyone but those in the mainstream know the numbers are extremely faulty. This is because underlying the primary rate is the fact that most jobs created since 2000 have been part-time lower wage ones, which in many cases were given to a combination of H1B and illegal foreign born workers.

The reality is, the economy has not truly recovered since the Dot Com crash of 2000, and instead was artificially propped up with tens of trillions in debt, and through created bubbles in equities and housing. And with 102 million working age Americans without jobs, and over 100 million reliant upon some government benefit just to survive, it is no wonder that the Federal Reserve and Janet Yellen have difficulty stating with conviction that any new policies they might implement will actually help the economy.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne