Ever since 2007 the United States has led the world in foreign acquisitions. However, with China already surpassing their last year’s numbers through the first five months of 2016, the Asian power is on pace to usurp America’s position as the global leader in offshore asset purchases.

China’s purchases of foreign businesses and assets extend all the way across the globe, including even the U.S. itself when it bought J.P. Morgan Chase’s headquarters a few years back.

Additionally, foreign purchases of assets are expected to increase as China begins full bore into their Silk Road initiative, adding both warehousing, transportation, and financial infrastructures in every country along the route from Korea to London.

China’s pursuit of acquisitions around the world has been a big trend for the global marketand it is now standing at a whole new height, a recent report says.

Chinese firms have struck $143.3 billion in overseas deals this year, according to a reportpublished by Dealogic, a financial information provider.

The number is even higher than China’s 2015 total — $106.8 billion. At this rate, China willbecome the world’s largest cross-border acquirer when the year of 2016 runs its course, thereport predicted.

The United States has topped the ranking in cross-border acquisition every year since 2007. - China Daily

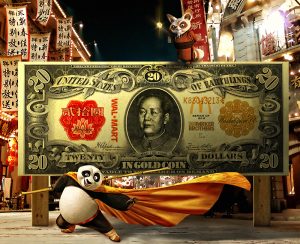

One of the big reasons for the increase in China’s acquisitions of commercial and residential properties outside of the mainland is the desire for many wealthy Chinese to get their own money offshore, and out of the yuan currency. This can be seen especially in the over paying for properties in both Canada and the Northwestern part of the United States, which has led to many of these areas experiencing a new housing bubble, and governments instituting new regulations on straw buyer purchasers.

Debates over offshoring assets to foreign countries and into foreign accounts has been a big agenda item for many Western governments following revelations discovered in the Panama Papers scandal. But since the U.S. and Eurozone nations are desperate to keep their own citizen’s money controlled within their own borders, they appear less likely to care if money coming in from China or Russia is buying up assets that their own investors can no longer afford to maintain.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.