The powers that be have learned to never let a crisis go to waste. And in the wake of last month’s Brexit vote which they desperately didn’t want to happen, mainstream financial analysts and central bankers are now shifting the UK vote into the perfect excuse to blame the oncoming global recession and financial collapse on that event and on the British people.

But for any real economist who isn’t a paid shill of the establishment, knowledge that the global economy and global financial systems were rushing headlong into crisis occurred long before the June 24 vote. And following the Federal Reserve’s stress test that ended last week, not only did two large European banks fail the test, but in Italy where no banks were deemed to be in trouble by the U.S. central bank, the first bailout outside of Greece is now taking place, and two institutions in London are halting redemptions in the nation’s largest property funds.

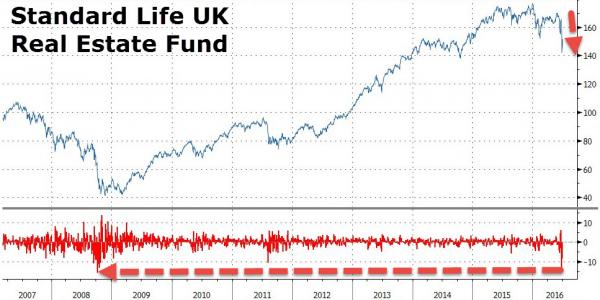

In the summer of 2007, two inconsequential Bear Stearns property-related funds were gated and then liquidated, exposing the reality of the US housing bubble and catalyzing the collapse of the financial system. While equity markets have rebounded exuberantly post-Brexit, suggesting all is well, British property-related assets have tumbled and, as The FT reports, Standard Life has been forced to stop retail investors selling out of one of the UK’s largest property funds for at least 28 days after rapid cash outflows were sparked by fears over falling real estate values. As one analyst warned, “the risk is this creates a vicious circle, and prompts more investors to dump property.”

Standard Life Investments has suspended trading on its £2.7 billion U.K. Real Estate fund, effective immediately, following Brexit, Investment Week reported, citing a statement.

The firm has suspended trading on the SLI UK Real Estate PAIF and the SLI UK Real Estate income and accumulation feeder funds.

The company cites “exceptional market circumstances” following an increase in redemption requests from the referendum.

The drop in NAV is the largest since Lehman… - Zerohedge

You know things are starting to crack when you see Bear Stearns and Lehman used in the same source to describe how bad an investment fund is.

Britain’s problems stem from their central bank President Mark Carney, who helped fuel a housing bubble there after he did the same in Canada as their central bank President in his previous job. And like Ben Bernanke and Janet Yellen on the U.S. side of the house, following Keynesian credit expansion policies to grow economies despite the fact that this has failed in nearly every country shows that the smartest people in the room are ill prepared to be running the world’s financial system.

Yet even more dire than the UK’s start to a popping of their housing bubble is the stability of several banks in Italy, and one behemoth in Germany, which at any time could cause a rippling effect that makes the 2008 Credit Crisis look like a small decline in the equity markets.

Now, three years later, the bomb appears to be on the verge of going off (or may have already quietly exploded), and nowhere is it more clear than in an exhaustive article written by the WSJ in which it focuses on Italy’s insolvent banking system, and blames - what else - the hundreds of billions in NPLs on bank books as the culprit behind Europe’s latest upcoming crisis.

To be sure, nothing new here, although it is a good recap of the Catch 22 Italy finds itself in: from the WSJ’s “Bad Debt Piled in Italian Banks Looms as Next Crisis”

Britain’s vote to leave the EU has produced dire predictions for the U.K. economy. The damage to the rest of Europe could be more immediate and potentially more serious. Nowhere is the risk concentrated more heavily than in the Italian banking sector. In Italy, 17% of banks’ loans are sour. That is nearly 10 times the level in the U.S., where, even at the worst of the 2008-09 financial crisis, it was only 5%. Among publicly traded banks in the eurozone, Italian lenders account for nearly half of total bad loans.

Years of lax lending standards left Italian banks ill-prepared when an economic slump sent bankruptcies soaring a few years ago. At one major bank, Banca Monte dei Paschi di Siena SpA, bad loans were so thick it assigned a team of 700 to deal with them and created a new unit to house them. Several weeks ago, the bank put the bad-credit unit up for sale, hoping a foreign partner would speed the liquidation process. - Zerohedge

There is a reason why gold and silver have skyrocketed since the beginning of the year, and why global bond yields are halfway to being completely negative returns for investors. It is because those who manage client and their own money know the writing is already on the wall for the next financial collapse, and are making every effort to get out now before the masses wake up and make leaving the room nearly impossible.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.