It has been about a decade since the last instance of true hyperinflation rocked a nation state, with Zimbabwe becoming the most recent ‘Weimar Republic’ example in the global economy. And while their solution was to simply stop printing their local currency and transition into using dollars (and now Yuan) as their domestic medium of trade, their overall impact on the global economy was relatively negligible.

But the same cannot be said for the newest partner in this auspicious club, as the IMF reported on Jan. 22 that Venezuela is beyond the point of no return, and should enter into the realm of hyperinflation by the end of 2016.

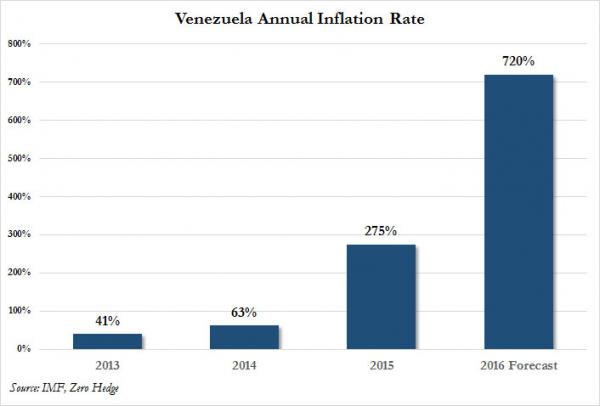

Bloomberg reports that inflation will surge to 720 percent in 2016 from 275 percent last year, according to a note published by the IMF’s Western Hemisphere Director, Alejandro Werner. That’s nearly quadruple the median 184 percent estimate from 12 economists surveyed by Bloomberg, and exceeding the highest forecast of 700 percent from Nomura Securities.

Venezuela’s central bank published economic statistics Jan. 15 for the first time in a year, confirming that inflation had reached triple digits and closed the third quarter at 141.5 percent on an annual basis. As of December 2014, the last time data was released, inflation was 68.5 percent.

It has gotten so surreal, that the local central bank accused websites that track the dollar’s street value of “destroying prices” and installing a “savage” form of capitalism in the country, adding that 60 percent of inflation was the result of currency manipulation.

Whatever the cause, the reality is that real inflation is even worse, and when charted, this is what the death of a sovereign nation looks as follows (this does not assume a sovereign bankruptcy; when that happens the hyperinflation will really take off): - Zerohedge

Venezuela’s dire economic consequences are not solely tied to the decline in oil prices, as their financial system has been under fire ever since former President Hugo Chavez took office and created a Marxist ‘paradise’ of price controls and nationalization of industry. But even then, it has been the pure catalyst of lower energy prices that appears to be pushing them over the edge into the realm of full blown hyperinflation.

There are many more oil based nations that are experiencing price inflation due to their declining energy exports and the high cost of importing goods. And thanks to the dollar’s long-term strength which has helped immensely in creating global price inflation to many regions of the world (see Arab Spring), the possibility of even more country’s following Venezuela’s lead are growing strong every day unless the world ends its current deflationary recession and brings about a new demand for oil.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.