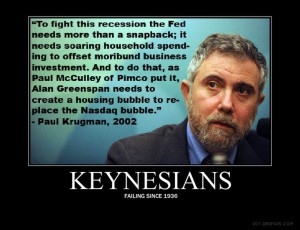

When the Nobel committee handed out their prize for Economics to Paul Krugman back in 2008, the selectors must have thought they were giving it to Jack Klugman as a life-time achievement award, because the sad fact is the man is little more than the butt of jokes when it comes to speaking out on financial and economic matters today.

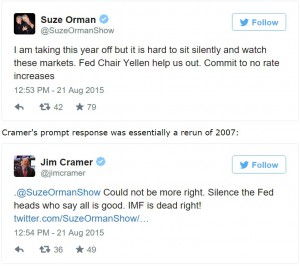

And as the equity and bond markets start to crack in the U.S. during this month of August, the winner of the once meaningful Nobel Prize in Economics came out on Aug. 21 and said that the solution to this new and growing financial debt crisis is…

More debt.

Believe it or not, many economists argue that the economy needs a sufficient amount of public debt out there to function well. And how much is sufficient? Maybe more than we currently have. That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.

I know that may sound crazy. After all, we’ve spent much of the past five or six years in a state of fiscal panic, with all the Very Serious People declaring that we must slash deficits and reduce debt now now now or we’ll turn into Greece, Greece I tell you.

But the power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt.

Why?

One answer is that issuing debt is a way to pay for useful things, and we should do more of that when the price is right. - New York Times

In the 1980’s the U.S. national debt stood at barely over $1 trillion, and interest rates were up near 20%. And yet despite the fact that deficits were fairly minimal during the time of vast economic recovery, it was production, not credit based consumer spending, that made up the lion’s share of our nation’s GDP.

It was only after Alan Greenspan came into office in the mid 1990’s at the Federal Reserve that the national debt vastly increased under a scheme of cheap money, low interest rates, and wild speculation. And 20 years later, our nation now has a debt of more than $18 trillion with annual deficits of over $1 trillion.

But this doesn’t even count the global impact that debt has had on major crises over the past 35 years. During the 1980’s, Latin America experienced debt crises that destroyed their economies for well over a decade, with some nation like Argentina falling back into collapse just years after coming out of a long-term depression. And of course in the 1990’s Asia became the recipient of a debt crisis that brought about a global recession, in which that cycle was turned around artificially by… you guessed it…

more debt.

So with several years of global money printing and currency devaluation not seen since the Depression eras of the 1920’s and 30’s, and a global debt of well over $230 trillion, it is simply insane to believe that the infusion of more money, which would only be created by more debt, could stem the oncoming freight train of collapse that is facing nearly every economy on the planet. But this is exactly what the Fed, the clowns of mainstream finance, and of course, a Nobel Prize winner, are clamoring for since the inability of the world’s leadership to actually fix the problem is without a doubt well beyond their abilities and intellect to accomplish.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.