For the past 43 years the world has had to use the dollar as the primary medium of exchange when conducting international trade. In fact, this ability to control the global reserve currency has been the key catalyst in supporting U.S. hegemony around the globe.

But over the past three years China has been slowly usurping market share of the dollar through its programs of direct bi-lateral trade and the duplication of Western financial infrastructures, and on Aug. 1 they announced that they plan to use the IMF as the entity to crack the polar reserve currency even more by calling for the issuance of a ‘M’ SDR.

When Bloomberg reported late last year that China founded a working group to explore the use of the supranational Special Drawing Rights (SDR) currency, nobody took heed.

Now in August of 2016, we are very close to the first SDR issuance of the private sector since the 1980s.

The International Monetary Fund (IMF) itself published a paper discussing the use of private sector SDRs in July, and a Chinese central bank official confirmed an international development organization would soon issue SDR bonds in China, according to Chinese media Caixin.

Caixin now confirmed which organization exactly will issue the bonds and when: The World Bank and the China Development Bank will issue private sector or “M” SDR in August. - Epoch Times

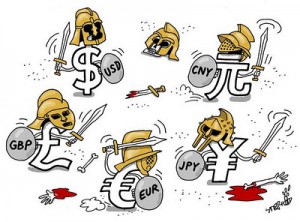

The IMF’s Special Drawing Rights (SDR) basket of currencies is an accepted global reserve instrument in its own right, but has had limited use since the U.S. is able to provide plenty of dollars to foreign economies to allow for uninhibited trade. But as the American central bank has devalued the dollar over the past eight years since the 2008 Credit Crisis, the current reserve currency has helped to generate massive inflation internationally, and trigger the global currency war that has been in play since 2009.

Just like so many Americans this year are choosing to vote for anti-establishment candidates for President in 2016, so too is the rest of the world looking for a new alternative to replace dollar hegemony in international trade. And besides the steady rise of the Chinese RMB, which has taken over 13% of the dollar’s ‘market share’ in just the past three years, the Asian economic power is now doubling down and looking to provide countries a secondary alternative through the widespread issuance of the SDR.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.