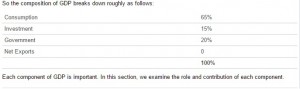

Although we have mentioned it several times, the primary factors that make up U.S. GDP are consumer spending, and government spending. Combined these two categories within the Gross Domestic Product account for 85% of the total production numbers.

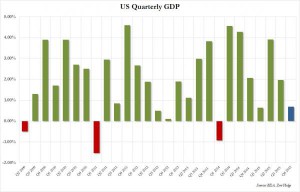

So when 4th Quarter GDP growth came in at less than 1% on Jan. 29 (.69%), it validated that sales over the holiday shopping season were incredibly dismal, and that consumers are close to tapped out when it comes to buying products in the economy.

Yet perhaps what is most disturbing is what the number one item and cost to consumers was in the 4th quarter. And not surprisingly it was Obamacare premium payments, which have on average doubled for every family in the U.S. since the boondoggle was foisted upon the American people by Congress in 2010.

By now, not even CNBC’s cheerleading permabulls can deny that the US is in a manufacturing recession: in fact, it is so bad that even the staunchest defenders of Keynesian dogma admit what we said in late 2014, namely that crashing oil is bad for the economy.

And yet, the “services” part of the US economy continues to hum right along, leading to such surprising outcomes as a stronger than expected print in Personal Consumption Expenditures. How can this be?

Simple: one look at the chart below should explain not only how the “services” half of the US economy continues to grow, but just which tax, because that is how the Supreme Court defined Obamacare, is responsible for healthcare “spending” amounting to a quarter of the growth in US personal consumption expenditures, almost 100% higher than the second highest spending category which was… Recreational goods and vehicles? - Zerohedge

When you think about just how bad .69% growth is, especially after the government decided last year to insert 2 (not 1) ‘seasonal adjustments’, you find that this number is little more than a rounding error, and that it is far likely that we had negative GDP growth for the last quarter when you remove the fake adjustments used to spin data towards a more positive light.

Both the government and the mainstream media will not tell you when the economy is in recession until several months or even years into it to protect their own interests. But all one has to do is look at oil prices, real consumer spending (use of credit instead of cash), deflation, and production/inventories to know that the world is in a full all-out recession, and central banks no longer have the will or ammunition to do anything about it.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.