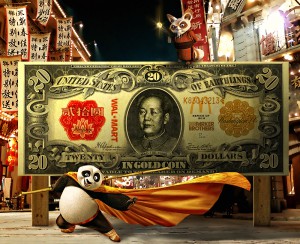

On Aug. 19, the IMF announced that they were delaying the decision to include the Chinese Yuan (RMB) into the SDR basket of currencies for at least one year, or until Sep. 30, 2016. The decision to exclude the Yuan in next year’s basket content was determined a week ago, but the announcement to go forward with allowing China to stabilize and strengthen its currency was only released today.

IMF executive board extends current composition of its Special Drawing Rights for nine months until Sept. 30, 2016.

IMF staff had recommended extending the current basket, which was due to expire Dec. 31, to minimize disruption if yuan added.

Board decision gives SDR users “sufficient lead time to adjust in the event that a decision were to be taken to add a new currency to the SDR basket”

Board made decision Aug. 11, IMF says in statement - Bloomberg via Zerohedge

The ramifications of this denial of the RMB could have some interesting and perhaps destructive effects for the dollar, and for how China chooses to move forward in their goal of having the Yuan function as a de facto reserve currency. In the last year alone, China has opened the Asian Infrastructure Investment Bank to compete with the IMF, the BRICS bank to compete with the World Bank, the Shanghai Gold Exchange to compete with the Comex and London Gold Fix, and a new SWIFT system to expand the use of the Yuan in bi-lateral trade.

It is probably no coincidence that China’s equity markets crashed in the days leading up to the IMF’s final decisions, and that China responded with a currency devaluation which crushed carry traders who used the Yuan in their speculative bets. And it is becoming more apparent that the IMF’s decision to keep the second largest economy’s currency out of the global SDR was done under pressure from the U.S., and as a chess move in the global currency war meant to keep dollar hegemony alive for a little while longer.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne