As Hillary Clinton is all but a given to be the Democratic nominee for President in the November election, the Republican party is moving to to try to beat her and Bill twice this year. That is because according to a new report on what planks will make up the GOP’s convention platform this year, repealing the Gramm-Leach-Bliley Financial Services Modernization Act of 1999, and returning Glass-Steagall, appears to be on the top of the list.

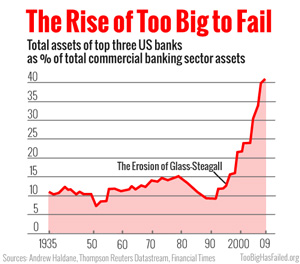

Under former President Bill Clinton, and with the help of bought and paid for establishment Republicans, the Great Depression safeguard known as Glass-Steagall was repealed in the late 1990’s, and was the catalyst for the creating of ‘too big to fail’ banks. This of course set in motion the ushering in of the financial collapse that nearly destroyed the global economy in 2008.

The GOP joined the Democrats in calling for a repeal of Gramm-Leach-Bliley, the Financial Services Modernization Act of 1999 pushed through by none other than Bill Clinton, and will seek a return to Glass-Steagall, the banking law launched in 1933 in the aftermath of the Great Depression meant to prohibit commercial banks from engaging in the investment business, and which according to many was one of the catalysts that led to the Global Financial Crisis.

According to The Hill, Paul Manafort, Donald Trump’s campaign manager, told reporters gathered in Cleveland Monday that the GOP platform would include language advocating for a return of that law, which was repealed under President Bill Clinton, husband of, well you know…

“We also call for a reintroduction of Glass-Steagall, which created barriers between what big banks can do,” he said. - Zerohedge

The primary purpose of Glass-Steagall was to keep separate commercial and investment banking functions, and to limit the liabilities of depositor monies being used for Wall Street speculation, as was done during the stock market boom of the 1920’s. But following an estimated $300 million spent over two decades by the financial industry in lobbying Congress to get the law repealed, it gave rise to monstrosities like Citigroup, which with several other banks leveraged the global financial system to its present day burden of nearly one quadrillion dollars in derivatives.

For over six decades the financial system was relatively stable, and able to withstand the occasional hiccup that came about from events such as the Savings and Loan Crisis, and the 1987 stock market crash. But since Glass-Steagall has been removed, credit and speculation has grown so much and so fast in such a short period of time, that one has to wonder if a re-passage of the banking bill will be enough to correct the financial ship, or if the system is just too far gone and will be headed soon towards an end game collapse.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne