When it comes to the financial state of most of the world’s economies, Greece is simply the most popular one right now to discuss within the daily news cycles. However, since the inoculation given by most central banks after the 2008 credit crisis was to increase debt in an attempt to both recover from recession, and stimulate economic growth, the cure is proving to be much worse than the disease.

Greece has an unsustainable debt that has been conceded to by both the IMF and ECB, but the Southern European nation is just the tip of the iceberg for a growing epidemic of countries that are already insolvent, and carrying so much debt that it is mathematically impossible for them to pay off in this current monetary climate. In fact, there are at least 24 insolvent and bankrupt nations, with another 14 very close to that same level, that are the tip of the iceberg since there appears to be no end to the debt plague that has engulfed the entire world like a ever growing black hole.

According to a new report from the Jubilee Debt Campaign, there are currently 24 countries in the world that are facing a full-blown debt crisis…

■ Armenia

■ Belize

■ Costa Rica

■ Croatia

■ Cyprus

■ Dominican Republic

■ El Salvador

■ The Gambia

■ Greece

■ Grenada

■ Ireland

■ Jamaica

■ Lebanon

■ Macedonia

■ Marshall Islands

■ Montenegro

■ Portugal

■ Spain

■ Sri Lanka

■ St Vincent and the Grenadines

■ Tunisia

■ Ukraine

■ Sudan

■ Zimbabwe

And there are another 14 nations that are right on the verge of one…

■ Bhutan

■ Cape Verde

■ Dominica

■ Ethiopia

■ Ghana

■ Laos

■ Mauritania

■ Mongolia

■ Mozambique

■ Samoa

■ Sao Tome e Principe

■ Senegal

■ Tanzania

■ Uganda

However, this list does not even include nations that are still able to print debt in large quantities, and are 100% reliant on this debt to keep their economies from systematically succumbing to full implosion.

Many analysts, including well known economist Jim Rickards, have already stated that the U.S. central bank is insolvent and the days of the dollar remaining as the global reserve currency are limited. And since nearly every country in the world now functions under a fiat monetary system built on debt creation to backstop their currencies, their thinking over the past 60 years has been one where they could continue in this paradigm of eternal debt creation without a single thought to the consequences of economic and natural laws.

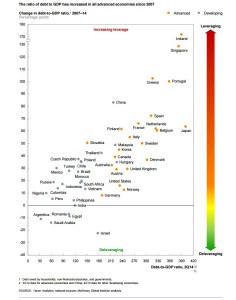

What is going on in Greece is simply a microcosm of the entire global financial system, where nations now rely too much on debt and not enough on real production to keep their economies from collapse. But as more and more nations reach and then breach a 100% debt to GDP ratio, the reality that this debt can not be paid off will finally hit countries and governments one after the other, and what Europe is experiencing in just one country will escalate into a full blown epidemic touching upon a global debt crisis of biblical proportions.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.