When central banks embark on fiscally irresponsible monetary policies, they tend to create anomalies that lead to economic crashes, bubbles, and as we are seeing in places like Greece and Japan, eternal deflationary growth.

But the United States for the time being is different, and this is because they still remain the sole keeper of the global reserve currency. And this means that they can print endless money without thought, at least until the consequences of ignoring reality comes to bear.

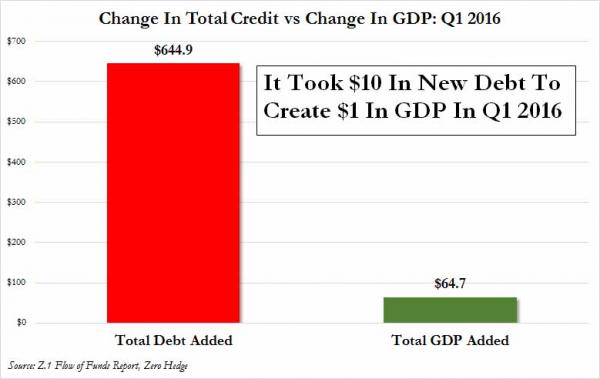

Following endless zero interest rates and four different quantitative easing programs, a number of anomalies have arisen that are becoming impossible to ignore, and even more difficult to counter. The first is that they have created so much debt that it requires the creation of new credit simply to remain static within the current economy. And secondly, that debt creation has completely wiped out the concept of capital, where a new report by the Bureau of Economic Analysis shows that it now takes $10 of new debt just to create $1 of new GDP growth.

According to the latest BEA revision, nominal Q1 GDP was $18.23 trillion, an increase of just $65 billion from the previous quarter or an annualized 0.7% rate, the question is how much credit had to be created to generate this growth. Well, according to the Z.1, total credit rose to a new record high $64.1 trillion. This was an increase of $645 billion from the previos quarter. It means that in the first quarter, it “cost” $10 in new debt to generate just $1 in new economic growth! - Zerohedge

And this is just one quarter of debt/gdp growth in one country. Imagine how much it now takes worldwide to achieve GDP growth in the overall global economy.

Perhaps this is also why the World Bank earlier this week downgraded their forecast for 2016 growth to 2.4% from its initial prediction of 2.9%.

With unsustainable debt being coupled with deflation, and most probably a global recession, the debt/gdp ratio of 10:1 will only get worse. And at the end of this will be a result where the economy reaches a point of critical mass, and no amount of new debt created will even be able to create one more dime of GDP growth.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.

Don't miss these

- Non Gamstop Casinos UK

- Best Casino Not On Gamstop

- Siti Sicuri Non Aams

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Casino Online Stranieri Non Aams

- Non Gamstop Casino

- Sites Not On Gamstop

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Casino En Ligne

- Casino En Ligne

- Casino En Ligne France

- 信用 できるオンラインカジノ

- UK Casino Not On Gamstop

- Casinos Not On Gamstop

- Casino Online Non Aams

- I Migliori Casino Non Aams

- Siti Casino Online Non Aams

- Non Gamstop Casino Sites UK

- Casino En Ligne Fiable

- Best Non Gamstop Casinos

- Non Gamstop Casino

- Betting Sites UK

- Casino Non Aams

- Crypto Casino

- Meilleur Casino En Ligne Français

- Casinos Belgique

- Casino Online

- Paris Sportif Ufc

- オンラインカジノ 出金早い

- KYC 없는 카지노

- казино онлайн

- Migliori Siti Scommesse

- Casino Online

- Casino En Ligne Fiable

- Casino En Ligne 2026

- Nouveau Casino En Ligne France

- Casino En Ligne