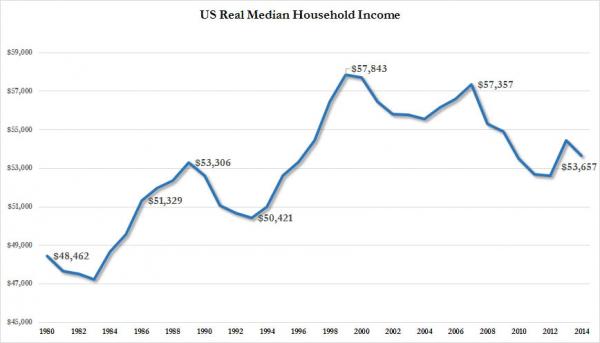

A few days ago Donald Trump was giving a speech to workers and supporters in the swing state of Ohio, and when it came to focusing in on the state of the economy, the Republican Presidential candidate made some interesting assessments that has the media suddenly going out of its way to try to discredit and vilify.

And what did he happen to say that has the establishment in an absolute tizzy? He said the truth that the entire ‘Obama recovery’ was simply a smoke and mirror job created by the Federal Reserve to artificially prop up both stock markets and economic data through the creation of tens of trillions of debt, and in their keeping interest rates at historic lows.

Republican presidential nominee Donald Trump weighed in on the Federal Reserve debate on hiking interest rates before Election Day blasting the Central Bank for masking the failures of President Obama’s “false economy” which he argues has not truly recovered since the 2008 crash.

“They’re keeping the rates down so that everything else doesn’t go down,” Trump told reporters when asked whether the Federal Reserve should increase interest rates. “We have a very false economy.” “At some point the rates are going to have to change,” Trump explained while campaigning in Ohio on Monday. “The only thing that is strong is the artificial stock market.” - Sputnik News

No matter how much the Obama Administration has been able to ‘massage’ economic data through ‘double seasonal adjustments’ and removing millions of people from being counted in the unemployment reports, the fact of the matter is he is expected to become the first President in history never to have a single year of 3% economic growth during his tenure in office. And while it is true that the stock markets have not only recovered from their 40% drop following the 2008 Credit Crisis to soar to new all-time highs over the past eight years, many analysts now admit that investing no longer requires an understanding of fundamentals and technicals, but rather by simply following the new moniker of Don’t Fight the Fed.

Because what the Fed (the central bank) does can have a significant impact on the economy and stock market, its policies are widely followed by money managers, analysts, traders, and investors. When the Fed loosens monetary policy, it’s often see as a positive. Conversely, when it tightens monetary policy, it’s something to be aware of. That’s where the “don’t fight the Fed” approach comes from. - Market Realist

The Fed caused 93% of the entire stock market’s move since 2008: Analysis

The S&P 500 (^GSPC) doubled in value from November 2008 to October 2014, coinciding with the Federal Reserve Bank’s “quantitative easing” asset purchasing program. After three rounds of “QE,” where the Fed poured billions of dollars into the bond market monthly, the Fed’s balance sheet went from $2.1 trillion to $4.5 trillion.

This isn’t just a spurious correlation, according to economist Brian Barnier, principal at ValueBridge Advisors and founder of FedDashboard.com. What’s more, he says previous bull runs in the market lasting several years can also be explained by single factors each time.

Barnier first compiled data on the total value of publicly-traded U.S. stocks since 1950. He then divided it by another economic factor, graphing the ratio for each one. If the chart showed horizontal lines stretching over long periods of time, that meant both the numerator (stock values) and the denominator (the other factor) were moving at the same rate. - Yahoo Finance

So in the end Donald Trump is dead right, and the entire mirage of an ‘economic recovery’ is based solely on zero interest rate policies, cheap money, and trillions of dollars in stimulus which the Fed has used to funnel into the stock markets, and on many occasions, drive HFT algorithms to move to buy stocks. And when January of 2009 comes around, and Barack Obama leaves office, the real economy will be no better off than had the Fed done nothing starting eight years ago.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.