In a new revelation that should not have been surprising to anyone, Goldman Sachs was discovered to have taken money from depositors and used it to make speculative bets in the markets to try to reap investment profits.

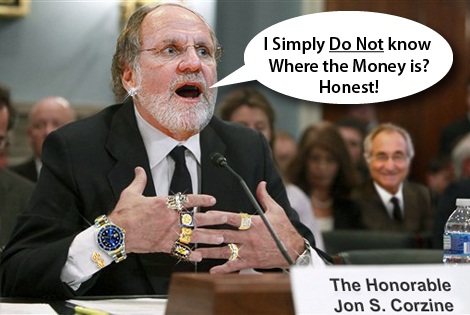

Unlike monies that are supposed to be segregated between investors, depositors, and the bank itself, Goldman Sachs has now followed in the footsteps of MF Global by re-hypothicating dedicated customer funds to use in market speculation without the knowledge or permission of the account holders.

As Goldman Sachs Group Inc (GS.N) has built its U.S. consumer bank, it has established a team to put its deposits to work on Wall Street, a telling development about Goldman‘s ambitions for the retail bank.

Led by 40-year-old Goldman partner and credit trading veteran Gerald Ouderkirk, the team’s job is to use consumer deposits and other types of funding for trades, investments and big loans to earn profits, people familiar with the matter told Reuters.

The existence of the team, which has not been previously reported, was set up in mid-2015 and is formally known as the institutional lending group. Lately, it has ramped up activities as GoldmanSachs looks to do more lending broadly.

Some Goldman executives bristle at the idea that Ouderkirk’s team is similar to chief investment offices, or CIOs, at bigger banks such as JPMorgan Chase & Co (JPM.N) and Bank of America Corp (BAC.N), since Chief Financial Officer Harvey Schwartz and Treasurer Robin Vince still manage the bank’s day-to-day liquidity, including how much capital Ouderkirk gets to work with.

Goldman spokesman Andrew Williams declined to comment or make Ouderkirk available for an interview. - Reuters

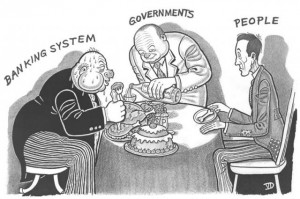

Yet what Goldman has been discovered to be doing with depositor money is the dirty little secret hidden within the the nefarious Dodd-Frank Wall Street Reform and Customer Protection Act of 2010 where depositor funds are now considered to be unfunded liabilities, and under the ownership of the bank rather than as an asset of the account holders themselves.

Thus simple bank depositors with Goldman Sachs have now become their new Muppets.

Sadly, the majority of Americans have never taken the time to see how their money, and the entire banking system changed following 2008, as most still trust their funds to financial institutions that regularly commit and are fined for fraud, corruption, theft, and manipulation. And despite the rise of de-centralized mediums of exchange such as bitcoin to try to provide an alternative to how people use money and perform commerce, they remain blind to the fact that not only is their money no longer theirs once they deposit it into one of these institutions, but is being used to bet on the same speculative securities that led to the financial collapse just eight years ago.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.