When Prime Minister David Cameron’s Tory party won the last British election with a resounding mandate, a key component of this was tied to a future referendum vote on whether to leave the European Union, or remain in its political sphere for the foreseeable future. But as Europe, the U.S., and most Western financial entities are beginning to financially breakdown, and show no signs of ending their money printing schemes, Britain is again looking Eastward and towards the Yuan as a serviceable replacement for the Euro or even the dollar.

The City of London is considered one of the three primary financial centers in the global economy, and when they decided over the past year to create a Yuan swap line and facilitate the selling of RMB denominated bonds, the writing was on the wall that Britain was going to look out for itself despite attempts by the Eurozone to lash together all nations under a singular monetary policy.

London and Beijing have agreed a number of initiatives including expanded currency swaps, stock market interconnection and Chinese investment in the UK’s nuclear power industry.

Britain’s Chancellor George Osborne is visiting Beijing and says the UK could be China’s best partner in the West.

The two countries are planning a yuan/sterling swap line expansion, along with the issuing of Chinese short term yuan debt in London soon.

The UK wants to continue to play a role as a leading world financial center in helping the gradual internationalization of the yuan, according to Osborne. - Russia Today

After the Federal Reserve’s signal last week that the U.S. and global economies are so unstable that not even a .25 bps rise of interest rates could be implemented, the U.K. did not take long before announcing proposals that centered around negative interest rates, and even an end to cash. However, the truth of the matter is that the problem rests with the dollar as the singular global reserve, and it is dollar protectionism that is at the heart of the world’s economies dissolving into currency wars that go back to as early as 2011.

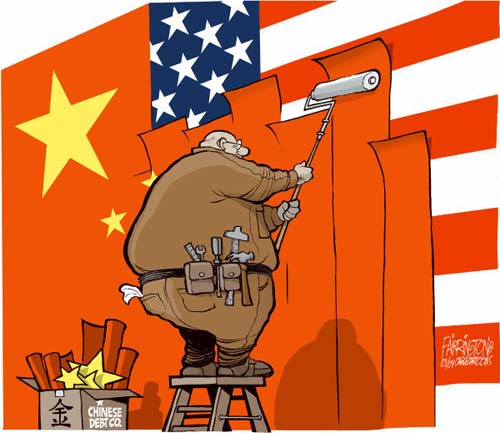

America relies heavily on Britian, Europe, Japan, the Middle East, and even China supporting the dollar, and dollar hegemony over oil and international trade. But as more and more nations seek to bypass the dollar middleman, and function in an environment of direct bi-lateral trade, this new agreement is just another nail in the coffin, and leaves Washington more and more isolated from a coming reset that will bring about a new global financial system.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.