Consumer spending and affordability of products and services are just one component of a domestic economic system that alone it is not enough to bring a complete lack of confidence to a nation’s financial system. But when you add in a growing decline in confidence for that nation’s currency, retirement programs, and investing structures, you have the ingredients for a rebellion that leads to collapse.

Hyperinflation has almost always been incorrectly defined as an out of balance expansion of a money supply, but the reality is, hyperinflation is a lack of confidence event, and it arises when consumers or producers are unwilling to accept assets denominated in the rejected currency at any price to purchase goods or services.

And it appears that this lack of confidence event may be occurring right now in Canada.

One of Canada’s biggest insurance and financial services companies says nervousness among Canadian investors has risen to levels not seen since the financial crisis.

Manulife Financial (TSX:MFC) says that Canadian investors have lost confidence in mutual funds, exchange-traded funds and balanced mutual funds over the past six months.

It also suggests that housing is seen as a less attractive investment, while confidence in fixed income investments has stayed about the same.

The report is based on Manulife’s semi-annual index of investor sentiment index, which dropped to 16 in December from 19 last May.

The index is based on investor views on a range of asset classes as well as their confidence in these areas.

Regionally, investors in Ontario and the Atlantic provinces were the most optimistic with a score of 20, while Quebec ranked lowest at nine. Alberta was second lowest at 14.

The skittishness among investors comes as stock markets have taken a beating and Canadians head toward the RRSP contribution deadline on Feb. 29.

The Toronto Stock Exchange has been under pressure in recent months and sits about five per cent lower compared with where it began the year and nearly 20 per cent lower than its highs of last year.

At the same time, the Canadian dollar has managed to hit lows not seen in more than a decade in recent weeks. - Times Colonist

Last month Canada announced a series of financial problems that stem from the global decline in oil prices, and what appears now to be a bursting of the country’s housing bubble. And with the Loonie falling by 30% in relation to the dollar in a short amount of time, imports which make up close to 85% of all food consumed inside Canada have driven up prices 200% or more in some instances.

Yet even this may be just a prelude of things to come as Canada sits on the precipice of instituting negative interest rates that will devastate savers and those holding cash in any investment, and may just cause the growing lack of confidence to become permanent.

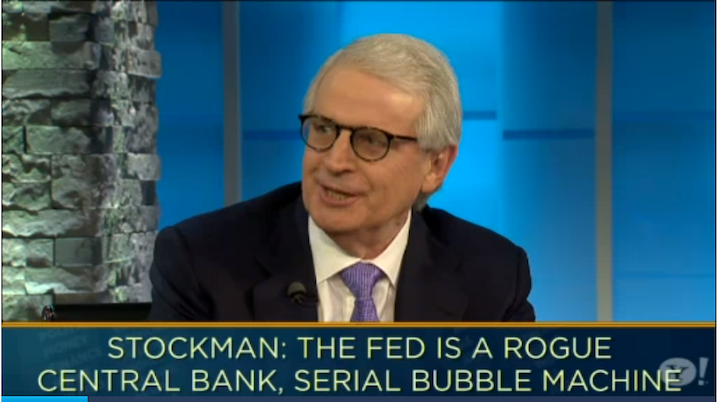

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.