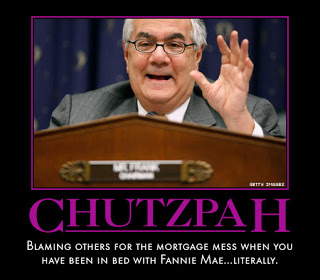

Former Congressman and co-creator of the nefarious Dodd-Frank Wall Street Reform Act, Barney Frank, spoke to The Hill over the weekend and told the publication that he is advising the Federal Reserve to do everything in their power to stop the market from crashing before the November election. And this especially includes ensuring that there are no rate hikes in September which could severely diminish Hillary Clinton’s chance of winning the election due to market reactions from the raising of interest rates.

For years Barney Frank served as the Chairman of the House Financial Services Committee, where he used the office to protect Wall Street and the big banks from both Congressional scrutiny, and from legislation that would have curtailed much of their fraudulent practices.

Former Congressman Barney Frank, one of the architects of the failed Dodd-Frank “Wall Street Reform” act” called on the apolitical Federal Reserve to keep interest rates low fearing that if the American economy slipped into recession Hillary may lose.

One of the central tenets of the Trump campaign is that the US economy has been artificially inflated due to the Federal Reserve flooding the market with cheap money and that when the central bank eventually reverses its backdoor stimulus policy the reality of the country’s economic woes will come crashing all at once. It appears that is a view shared by Hillary’s top financial expert Barney Frank.

Frank advised the Federal Reserve Board “not to risk destabilizing the market” and perhaps the broader economy a few weeks before Election Day. “I think it would be a mistake to do this close to the election,” Frank told The Hill. “It will be interpreted, over interpreted.” - Sputnik News

Unfortunately for Barney Frank, the Fed is experiencing a crisis of confidence by the American people, as well as by Wall Street itself which was seen in full view on Friday in the markets. Beginning early in the day when Federal Reserve Chairman Janet Yellen spoke in a vague way that a rate hike may or may not take place in either September or December, her words where then contradicted by Vice-Chairman Stanley Fischer a few hours later when he impressed that a rate hike next month was a high probability.

And we saw the market reaction during each of their interviews.

During his several decades tenure in office, Barney Frank was a tool of Wall Street, as well as a politician who put the establishment above the good of the people. And just as he helped replace responsibility for bailing out the banks from the government to depositors with his Dodd-Frank reform Act, so too is he willing to throw Americans under the bus by calling for the Fed to do everything in their power to ensure a corrupt Presidential candidate wins the White House, even if it means the future economic crash will be a whole lot worse.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Examiner.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.