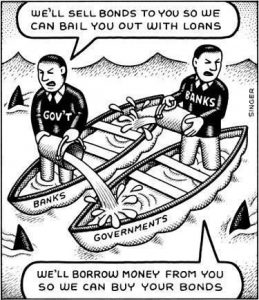

Last year the European Commission passed a law that forced all EU countries to enact their own bail-in programs in the event of bank insolvencies. In fact, the EC was so adamant that taxpayers would no longer be allowed to assist in bailing out banks that the Commission took four governments to court leading up to the Dec. 31 deadline.

But as with all ideologies, they are quickly discarded when a crisis takes place. And with Germany’s Deutsche Bank on the cusp of its own insolvency and potential meltdown in its $40+ trillion derivative book, the EC is now backtracking and is discussing new legislation to create a European derivatives clearing house that would be funded by you guessed it…

taxpayers.

And so, as Bloomberg reports, the dear old European taxpayer is about to save the world… The European Union plans to give authorities sweeping powers to tackle ailing derivatives clearinghouses to prevent their failure from wreaking havoc throughout the financial system.

Draft EU legislation seen by Bloomberg sets out rules on saving or shuttering clearinghouses that would apply to firms such as London-based LCH. The proposals cover everything from the creation of resolution authorities to the powers they would have when winding a company down, including writing down shares, debt and collateral.

Having forced most clearing to go through central counterparties to manage risk in the financial system, the EU will come out with recovery and resolution proposals by year-end. Clearing has come into focus after emerging as a pawn in the post-Brexit battle for London’s financial-services industry.

“If we are going to rely more on CCPs, we need to have a clear system in place to resolve them if things go wrong,” Valdis Dombrovskis, the EU’s financial-services chief, said last month.

Governments around the world were spooked by the damage inflicted by derivatives trades that went awry during the financial crisis. Since then, they’ve taken steps to ensure trading in the contracts is reported and centrally cleared.

Clearinghouses stand between the two sides of a derivative wager and hold collateral, known as margin, from both in case a member defaults.

The plan’s upfront costs for clearinghouses “are estimated to be in the millions for the largest institutions and in the thousands for smaller entities,” according to the summary of an EU impact study.

Costs for “better planning and prevention of failure” will vary by firms’ “size, interconnectedness, substitutability and complexity.”

While the process is taking risk out of the banking system, it has increased it in the clearinghouses, which might get into difficulty after the default of a clearing member — typically a major bank — or after some operational failure that inflicted major losses.

In both cases the authorities would need to act quickly and would be doing so amid a looming crisis. - Zerohedge

At stake in this contradictory move by the European Commission is the potential to alienate, and perhaps even drive out Southern European countries like Greece, Spain, and Italy who have all been forced to impose austerity measures over the past six years because they were disallowed from implementing their own taxpayer funded bailouts to save their banks. And as many Europeans today believe the EU itself is simply an arm of German hegemony, to change the rules at this time to help bailout a German bank could be the catalyst for both disunity within the EU, and also more Brexit style votes that would collapse the European Union entirely.

It is bad enough that depositors are now on the hook for the mistakes and risky speculations of private banks, but to once again place the onus on the taxpayers is something that could drive civil unrest all across the European continent. And like with the bailouts following the 2008 crisis, and then the subsequent QE and zero interest rate mechanisms that aided only Wall Street versus the economy as a whole, in the eyes of EU bureaucrats their only focus has always been on protecting the banks, and not the people who have suffered greatly due to the failures of these financial institutions.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com, Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.