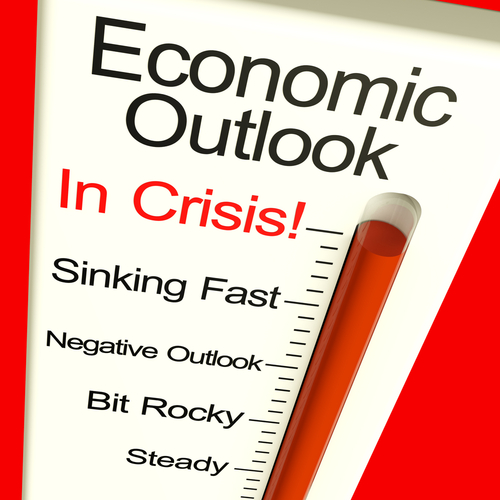

On Sept. 27 the World Trade Organization (WTO) cut its forecast for global trade in 2016 by 1.1% to the lowest levels since the Great Recession period of 2009-10.

Originally forecasting a growth rate of 2.8% earlier this year, the rise in rejecting globalism is being named the primary reason for the decline in international trade by the WTO.

The World Trade Organization (WTO) has cut its forecast for global trade growth this year by more than a third, saying it’s the first time in 15 years international commerce will slip below GDP.

According to the WTO, global trade will expand by merely 1.7 percent this year which is well below the April forecast of 2.8 percent.

The forecast for 2017 has also been downgraded. Trade is now expected to grow between 1.8 percent and 3.1 percent, down from 3.6 percent.

“The dramatic slowing of trade growth is serious and should serve as a wake-up call. It is particularly concerning in the context of growing anti-globalization sentiment,” said WTO Director General Roberto Azevedo.

This year trade will grow only 80 percent as fast as the global economy, the WTO said, adding it will be “the first reversal of globalization since 2001 and only the second since 1982.” - Russia Today

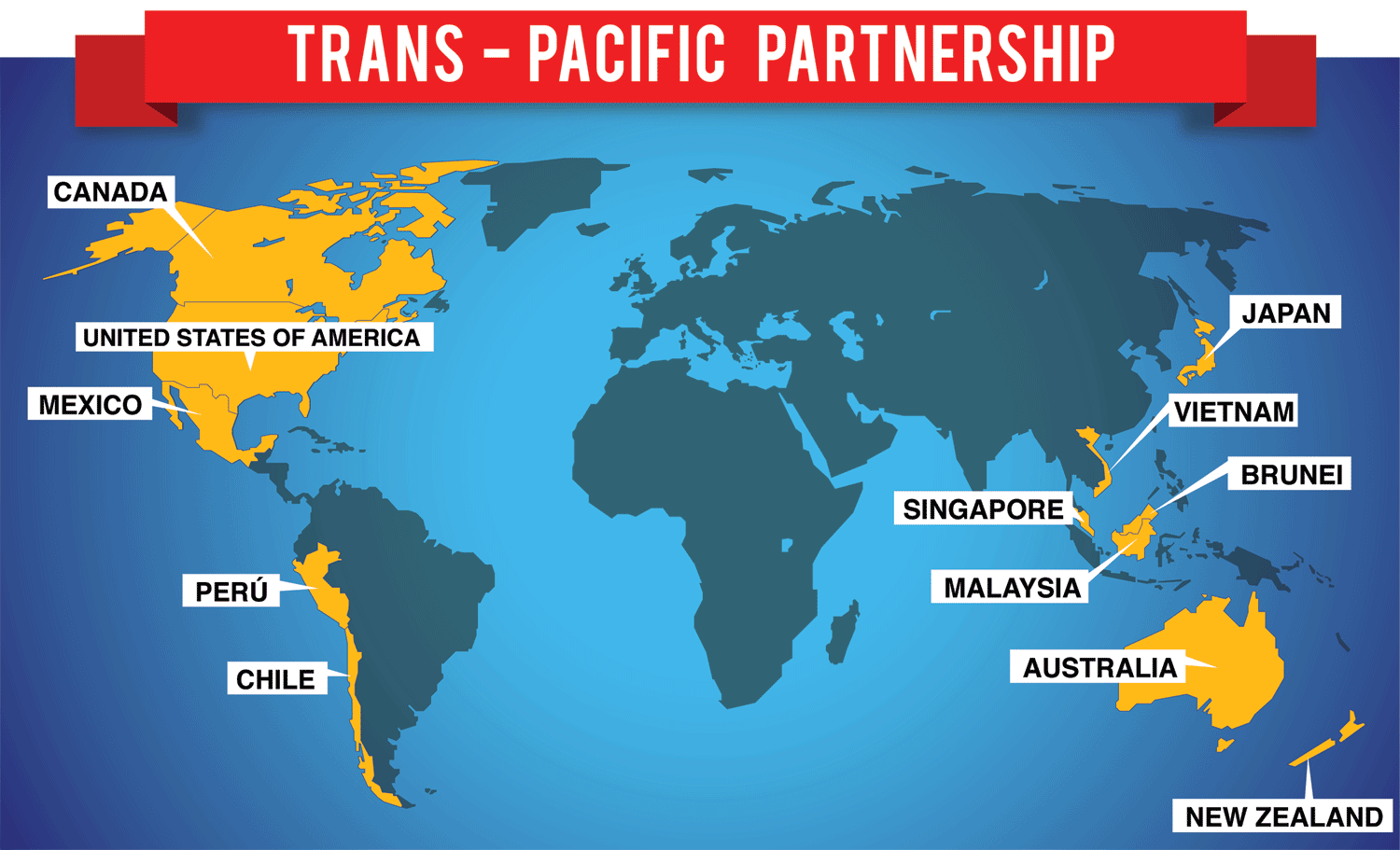

The rise against globalism and expansionary trade agreements such as the Trans-Pacific Partnership and the Trans-Atlantic Trade and Investment Partnerships are just some of the reasons behind the declines in global trade for 2016. However, what is not being talked about in the mainstream is the concrete evidence showing that most of the world is currently in a new recession, as seen by the lack of demand for energy, automobiles, and other bellweather goods.

When central banks began using money printing and zero interest rate policies to artificially kick start markets in 2010, they failed to deal with the underlying issues that led to the near depressionary environments that emerged following the 2008 financial crisis. And with these same banks now unable to create any real growth through their monetary policies, as seen by the fact that the U.S. alone has not had a 3% rise in GDP in over eight years, it was only a matter of time before the fragile foundation of creditism began to break, and the consequences of simply masking bad economies is now coming back to the forefront.

Kenneth Schortgen Jr is a writer for Secretsofthefed.com,Roguemoney.net, and To the Death Media, and hosts the popular web blog, The Daily Economist. Ken can also be heard Wednesday afternoons giving an weekly economic report on the Angel Clark radio show.